I know an article on extended warranty scams might seem strange coming from an insurance blog, but I must confess to being kind of a scam hound. Being a businessman, I see more than my share of dubious offers. From 419 (Nigerian fortune) scams to internet directories that charge $750 for a listing on a web site that nobody uses or has ever heard of, I am pitched for some sort of scam almost every day. Sometimes, I can’t restrain my curiosity and have to investigate. Understanding how people scam is very useful in helping avoid them. Here is what I found when investigating extended warranty scams.

“Your factory warranty has expired!”

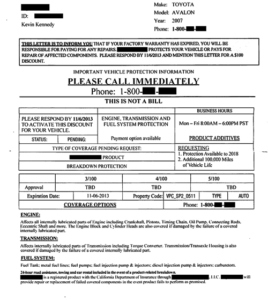

To start, I received this official looking, tear-off-the-perforations piece of mail. On the outside, it lists the year, make and model of one of my cars. It even included a dire warning that there are severe penalties for anyone interfering with the delivery of this piece of mail. I open it to find this:

(I have redacted the identifying information to protect the guilty and to save myself from a big pain in my posterior should some moron extended warranty scammer want to call me to try to threaten me to take this down. To those morons: If you do bother me, I will out you.)Hint: Scroll to the bottom of the page if you don’t want to read all the boring details of my ‘investigation’ into the extended warranty scam and just want to know what the scam is.

You’ll see that the efforts to sound official and ominous continue on the inside. What is also obvious is that they are trying to make this look like an offer for a vehicle service contract which is kind of like an extended warranty. I use the term extended warranty because that’s the common vernacular for such products.

Anyway, I was in an inquisitive mood so I called the scammers. Things must be going well in Scams-ville because it took them almost 5 minutes to pick up my call. The pitch-man was very eager to sign me up, but unfortunately my car didn’t qualify for their regular program but it did qualify for another program which would cover my car exactly as described in the letter. And I could sign up for that program for a mere $2,990. Of course I could make payments, $394 today and 15 additional payments of $173. It was a high pressure sales pitch that almost immediately asked me for my credit card information. I seemed a bit leery, so the pressure really got turned on high. “You have to get it now or your vehicle won’t qualify!’ “If you wait, it will become much more expensive!” Which are both common tactics in scam pitches. When I still hesitated, the guy put me on hold ‘to see what he could do for me’. After several seconds his “manager” picked up and I found out that, lucky me, he was going to give me the “special friends and family rate” which would lower my payments down to $194 down and 18-payments of $136.

Of course, I played like I was still skeptical, so I asked him to send me a copy of the extended warranty agreement I was purchasing. No problem, he said. We’ll send you a copy, after you make the down payment. No, I said, I need to see it to help me decide if I wished to purchase. We went round and round for several minutes, me asking for the agreement, him saying he couldn’t send it to me then trying to change the subject. Finally, he asked “don’t you trust me?” I had to be blunt, “No” I told him. It was at that point he directed me to the Better Business Bureau site where I could look up the company issuing the warranty. Lo and behold, they have an A+ rating! Of course, he glossed over the fact that they have well over 300 complaints (quite a lot for a podunk operation operating out of a strip mall). However, he readily pointed out to me that GEICO has more complaints than they do! Never mind that GEICO is one of the largest insurers in the US (still a lot of complaints though). If you are wondering how a company that engages in extended warranty scams could still have an A+ rating? They bought off the complaints. People were so desperate to get at least some money back, they agreed to mark their claim resolved for a payment and cancellation of their ‘extended warranty’.

I soon tired of this little exercise and tried to get off the phone. Not so fast there, Bucko! Like all good fast-talking scammers, he simply was not going to let me hang up. Fortunately, the disconnect button is readily available. But guess what? He called me back which surprised me because I had called him from a number that the caller ID is blocked. I didn’t pick it up, but it gave me a new phone number to investigate which led to another warranty scam company, presumably run by the same people.

What the Scam Actually Was

Reading the above notice, it’s not obvious that they aren’t selling an extended warranty. What this is actually selling are engine additives, oil additives, fuel additives and transmission additives. If you actually read the agreement (which I was able to find online since the scammer refused to give me one), the contract is essentially saying is that, if you put their additives in your car, they will protect your engine, transmission and fuel systems from failure. So it’s not an extended warranty or a vehicle service contract, it is actually a product warranty. However the contract is so limited and the exclusions are so numerous that this is essentially a worthless warranty. They cloak their product in deception because they know full well that no sane vehicle owner is going to pay almost $3,000 for some off-brand additives they could probably get at a local auto parts store for $20.

However, once I figured that out, I wanted to be thorough so I went and visited someone I know to be honest, trustworthy mechanic: Tony Esposito of A-Accountable Auto here in Apple Valley. Tony was quick to point out that there are a lot of extended warranty scams floating around out there and he has certainly seen his share. “Most of them ARE scams”, Tony told me. “They are very good at making sure most repairs aren’t covered.” Even some related items, like seals, are qualified in such a way that they are only covered if they are caused by the engine failure. As Tony explained to me, seal failures cause engine failures, not the other way around. “Before your engine will fail, you probably will have replaced your failing seals. If not,” he explained, “they will deny you for neglecting your failing seals.”

Customers, in good faith, buy vehicle service contracts but there is a large segment of them that are specifically designed not to pay. It had gotten so bad that regulators finally stepped in and started regulating the plans as insurance which in most states is heavily regulated. When that happened, they changed tactics, selling the additives instead but touting the warranty of the product in deceptive language you see on the mailer I got.

But Is It a Technically a Scam?

In my opinion, absolutely!

Webster defines scam as “a fraudulent or deceptive act or operation”. While this scheme may not technically be fraud, I think few can argue that it’s deceptive. Clearly they are hiding the true nature of the product warranty.

I am sure they would argue that they also sell other warranties that, theoretically, are better. But even granting them that, why would you want to do business with anyone who practices such deception?

Are Any Extended Warranty (Vehicle Service Contracts) Legit?

Yes, there are. Many reputable companies offer them. A strong test to determine if the contract is a scam is if it is offered at a time outside of the factory warranty, except when the vehicle is being sold. See, in that industry, all too often people go looking for coverage when something major happens like a blown engine or transmission and they can’t afford the $4,000 to fix it. Therefore it is wise for companies to not just accept someone out of the blue. Scammers aren’t worried about that, obviously, because their contracts are designed not to pay. Sadly, most people don’t pursue the matter when the repairs aren’t covered and they may never realize that they were sold garbage packaged as roses.

This is not to suggest that just because it is sold at a dealership, it is good. Many used car dealers sell the lousy contracts because it’s no skin off their nose when the customer gets their claim denied months down the road.

How to Avoid Being Scammed: Do Your Research

This age of the Internet makes it very easy to find out just about anything instantly. One thing to remember though, don’t let the sales person direct you where to go for your research. Remember in my case when the salesman eagerly directed me to the Better Business Bureau page. Do your own research, look for associated companies and search for them too. Keep in mind that it is normal for companies to get negative reviews from time to time, maybe even most of the time. But if every review for them slams them for scammy tactics, beware.

In Conclusion

There are a lot of shady warranty or “vehicle service contract” scams. Many prey on the elderly or poorer people who can’t afford to fix their cars if something goes wrong (or has already gone wrong). The internet is rife with cautionary tales and complaints about such companies. As these schemes became more and more prevalent, regulators across the country started to crack down on abuses. As with any scam, the scammers found that that they had to adapt to skirt those regulations. The “additive product warranty scam” is just the latest incarnation of this scam which has been around for years.

I signed up for a six month broad form auto insurance policy on autopay. Can the insurance broker automatically deduct from your acct without signatures for the policy renewal?

Likely they will, yes. If a policy is already on an auto-debit payment plan, it will continue with the renewal if there is no instruction to remove it or cancel the policy.

Be careful also with extended or aftermarket warranties. Usually there is an initial 30/day incubation period before a claim can be made. So don’t expect to be immediately protected.

Most legitimate plans are very stringent on their underwriting criteria. A chronic problem for legitimate extended warranty companies is that lots of people try to buy them to cover a loss that has already occurred. In other words, my engine blew I am going to go buy a policy to cover it. Clearly, if the insurance companies let those type of claims be paid, they would soon be out of business. In fact, I think that just the type of consumer that these bogus warranty scams (as described in the article) target.